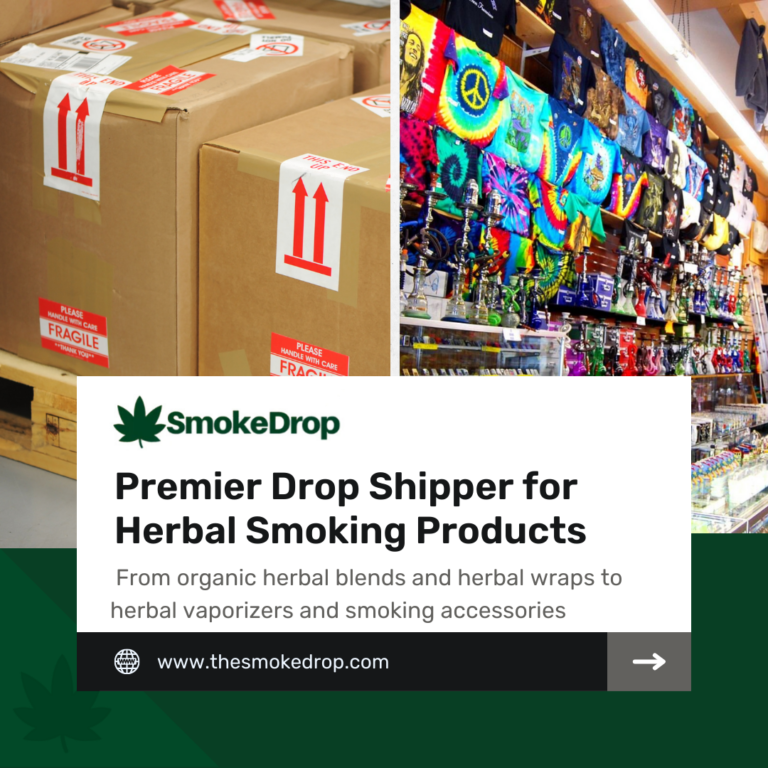

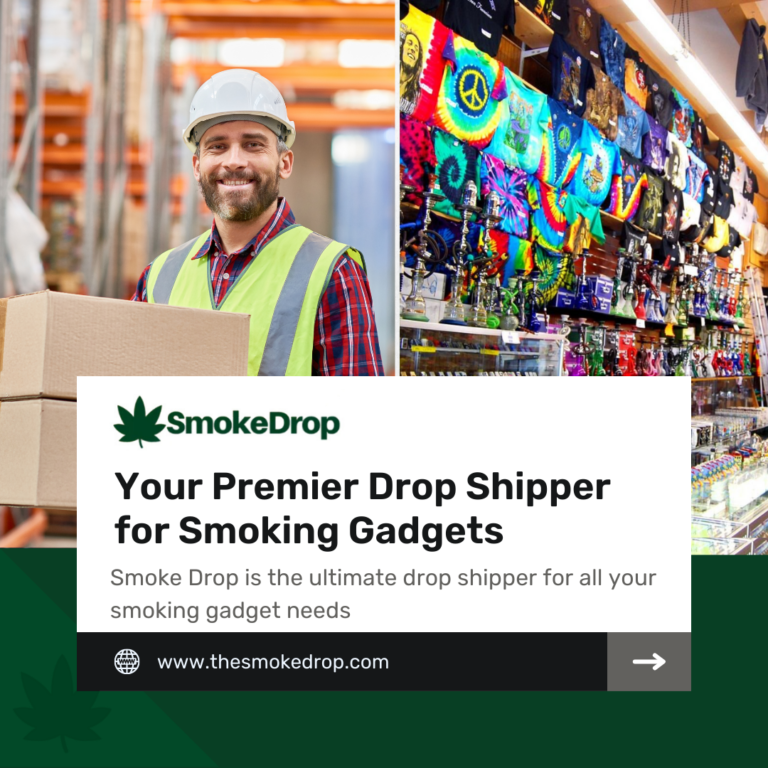

Dropshipping with SmokeDrop has become a beacon for individuals aiming to carve out their own niche in the bustling world of ecommerce. Many wonder how this business model, which allows for selling products without holding any inventory, can operate within the confines of the law.

The answer lies in understanding that dropshipping is not only legal but also a widely embraced method for doing business online. This realization opens up vast opportunities for aspiring entrepreneurs who are eager to step into the online retail space without the heavy burdens of traditional stock management.

One essential fact to grasp is that more than 30% of Amazon’s sales are fulfilled through dropshipping, highlighting its legality and significance in today’s digital marketplace.

By focusing on responsible practices such as adhering to tax laws, licensing requirements, and consumer protection regulations, anyone can legally run a successful dropshipping business.

This article aims to demystify the legal landscape surrounding dropshipping with SmokeDrop by guiding you through ensuring compliance with legal regulations and choosing reputable suppliers.

Key Takeaways

- Dropshipping is a legal and popular way to sell products online without holding inventory, with over 30% of Amazon’s sales made through this method.

- To stay within the law while using SmokeDrop, sellers must choose reputable suppliers, comply with consumer protection laws, and understand sales tax regulations.

- Being transparent in advertising and maintaining quality control are key practices for successfully running a dropshipping business through SmokeDrop.

Legalities of Dropshipping with SmokeDrop

Dropshipping with SmokeDrop is legal and offers various benefits. However, potential issues need to be understood and addressed for legal compliance.

Understanding the Dropshipping Model

Dropshipping is a business model where sellers can start an online store without needing to keep products in stock. Instead, they partner with wholesalers or suppliers who fulfill orders directly to customers.

This fulfillment method allows retailers to sell goods without handling the physical products themselves. The dropshipping model is legal globally and has gained popularity due to its low startup costs and ease of entry into the retail market.

Online marketplaces, including Amazon, have witnessed significant sales through dropshipping, with over 30% of Amazon’s sales each year fulfilled by this method.

In dropshipping, the retailer acts as a middleman between the customer and the supplier. They focus on marketing and selling products while delegating storage, packaging, and shipping responsibilities to third-party suppliers.

This lean supply chain management strategy reduces overhead costs for retailers since there’s no need for inventory space or large upfront investments in product stocks. A crucial aspect of operating a successful dropship business includes complying with tax laws, licensing requirements, and consumer protection standards without creating an LLC right at the start.

Moving forward from understanding how dropshipping works offers insight into the benefits this model provides both new entrepreneurs and established sellers seeking efficient ways to expand their online businesses.

Benefits of Dropshipping

Dropshipping offers several benefits for online sellers. It allows entrepreneurs to launch an online store without the need to manage inventory or handle product fulfillment. This model also enables retailers to offer a wide range of products as they are not tied to stocking specific items, thereby expanding their business opportunities significantly.

Moreover, dropshipping reduces upfront costs since merchants don’t have to purchase inventory before making sales, mitigating financial risks and allowing for more capital allocation towards marketing efforts and business growth.

These advantages make dropshipping an attractive option for those looking to start an online retail venture.

Moving forward from discussing the benefits of dropshipping, let’s delve into ensuring legal compliance with SmokeDrop in order to understand its intricacies better.

Potential Issues with Dropshipping

Transitioning from the benefits of dropshipping to potential issues, it’s important to note that while dropshipping offers various advantages, there are potential challenges to consider in this retail model.

Such difficulties include navigating sales tax laws, maintaining quality control with suppliers and ensuring compliance with consumer protection regulations. It’s crucial for SmokeDrop users to be aware of these challenges as they navigate their dropshipping business.

Ensuring legal compliance and navigating potential issues is a key aspect of running a successful dropshipping business using SmokeDrop. Business owners need to understand the intricacies of local sales tax laws, maintain transparency in advertising practices, and carefully choose reputable suppliers to avoid quality control issues.

By embracing responsible practices and understanding the complexities associated with dropshipping, SmokeDrop users can ensure their businesses operate within the bounds of legality.

Ensuring Legal Compliance with SmokeDrop

To ensure legal compliance with SmokeDrop, choose reputable suppliers and comply with consumer protection laws. Being transparent with advertising and maintaining quality control is crucial, along with understanding sales tax laws.

Choosing reputable suppliers

To ensure a successful dropshipping business with SmokeDrop, it is crucial to choose reputable suppliers who can uphold high-quality standards. Here are the key factors to consider:

- Reputation: Look for suppliers with a proven track record of reliability and professionalism in fulfilling orders.

- Product Quality: Ensure that the products offered by the suppliers meet high-quality standards to maintain customer satisfaction.

- Communication: Opt for suppliers who have prompt and effective communication channels for addressing any issues or inquiries.

- Fulfillment Efficiency: Select suppliers known for their efficient order processing and shipping to provide a seamless experience for customers.

- Ethical Practices: Partner with suppliers who adhere to ethical and sustainable practices, aligning with modern consumer preferences.

- Competitive Pricing: Work with suppliers offering competitive pricing without compromising product quality, enabling you to maintain healthy profit margins.

- Scalability: Choose suppliers capable of accommodating your business’s growth while consistently meeting demand without compromise.

By carefully evaluating these aspects when selecting suppliers, SmokeDrop users can establish a reliable and trustworthy supplier network, setting the foundation for a successful dropshipping venture.

Complying with consumer protection laws

To comply with consumer protection laws, SmokeDrop App users should ensure that their dropshipping practices adhere to relevant regulations. This includes choosing reputable suppliers to guarantee the quality and authenticity of products being sold.

It’s essential to be transparent with advertising, providing accurate information about products and services to potential customers. Adhering to sales tax laws is crucial for legal compliance in retail operations when using SmokeDrop.

Ensuring legal compliance goes beyond just making money online; it involves responsible business practices that contribute to a fair marketplace for both sellers and consumers. Therefore, maintaining transparency, quality control, and adherence to consumer protection laws are pivotal aspects of successful dropshipping through platforms like SmokeDrop.

Being transparent with advertising

When advertising products through SmokeDrop, it’s crucial to be transparent about the dropshipping business model. This means clearly disclosing the shipping and delivery times to customers, as well as being upfront about any potential issues that may arise with suppliers or product quality.

Transparency also extends to accurately representing the products in advertising materials and ensuring that all claims made about the products are truthful and substantiated.

Moving on to complying with consumer protection laws.

Maintaining quality control

Maintaining quality control is crucial for a successful dropshipping business. When selecting suppliers, SmokeDrop app users should prioritize reputable ones to ensure high-quality products for their customers.

This aligns with consumer protection laws and helps build trust in the brand. Furthermore, adhering to sales tax laws is essential when using SmokeDrop, ensuring legal compliance and avoiding potential issues down the line.

Transition: Now let’s explore “Understanding sales tax laws” as an integral aspect of legal dropshipping with SmokeDrop.

Understanding sales tax laws.

Transitioning from quality control to sales tax, it’s crucial for SmokeDrop users to understand sales tax laws when dropshipping. It is legal and necessary for online sellers to comply with sales tax laws in the United States.

This means collecting and remitting sales taxes on products sold in states where your business has a nexus, which can be achieved by using SmokeDrop’s built-in features to manage tax settings.

Failure to comply with these regulations may result in expensive penalties and fines.

Understanding the intricacies of sales tax laws ensures that SmokeDrop users maintain legality while maximizing their profits. By embracing transparent taxation practices within the platform, sellers can successfully navigate through this aspect of retail regulations, allowing them to focus on growing their businesses without legal concerns.

Conclusion

Dropshipping is a legal and efficient business model, offering an easy way to start a venture. Implementing responsible practices and ensuring compliance with relevant regulations are vital for success.

By choosing reputable suppliers and adhering to consumer protection laws, one can maintain quality control and transparency in advertising. These strategies not only ensure legal compliance but also lead to potential improvements and success in the dropshipping realm.

Readers are encouraged to apply these practical tips for legal dropshipping using SmokeDrop – a legitimate way to start a business online.

FAQs

1. What is SmokeDrop and how does it relate to dropshipping?

SmokeDrop is a platform for online selling that supports dropshipping, a fulfillment method where resellers don’t keep products in stock.

2. Is dropshipping legal using SmokeDrop?

Yes, dropshipping using SmokeDrop is legal as long as you follow business law guidelines and respect retail arbitrage rules.

3. How can I use SmokeDrop for my dropshipping business?

You can use SmokeDrop to find products, sell them on your online store, and when an order comes in, the product gets shipped directly from the supplier.

4. Can anyone become a reseller with SmokeDrop?

Absolutely! As long as you adhere to business laws and understand retail arbitrage principles, anyone can start their own online selling venture through dropshipping with SmokeDrop.